Technology SaaS M&A Update – Spring 2017

Published May 25, 2017

Key Trends in Technology and SaaS for 2017

Meridian Capital publishes its Technology M&A Update, which focuses on the software-as-a-service sector.

The M&A market for Software-as-a-Service companies remains robust, supported by the high growth profile and positive outlook for the industry as SaaS becomes the standard for software delivery. The industry continues to realize strong demand for SaaS products, with spending forecasted to grow to $16 billion in 2017, up from $8 billion in 2015, and reach an estimated $55 billion by 2026. Further, it is estimated that by 2019, over 20% of every dollar spent on software will be spent on SaaS products.

Meridian’s Technology Expertise

- Software

- Data Center & Cloud Solutions

- Tech-Enabled Business Services

- Digital Media & Marketing

Technology M&A Trends

The M&A market for Software-as-a-Service companies remains robust, supported by the high growth profile and positive outlook for the industry as SaaS becomes the standard for software delivery. The industry continues to realize strong demand for SaaS products, with spending forecasted to grow to $16 billion in 2017, up from $8 billion in 2015, and reach an estimated $55 billion by 2026. Further, it is estimated that by 2019, over 20% of every dollar spent on software will be spent on SaaS products.

New Industry Entrants Through Acquisition

- The M&A market has experienced new entrants on the buy-side from legacy on-premise software providers and non-software acquirers purchasing SaaS capabilities.

- From 2013-2018, on-premise software is projected to experience a 2.8% CAGR decline while SaaS is projected to experience a 17.6% CAGR growth rate over the same period. Legacy software providers are recognizing the need to innovate and capitalize on the industry momentum. Recent examples include Oracle’s acquisitions of OPOWER and Textura, and Microsoft’s acquisition of LinkedIn.

- Additionally, non-traditional software companies have become acquisitive in the space in order to promote cross-selling opportunities and realize cost synergies with their existing business lines. This trend has been illustrated with the legacy payment processor, Heartland Payments’ acquisition of Beanstalk Data in February 2016, as well as Pitney Bowe’s acquisition of Enroute Systems for $14 million. Other noteworthy transactions by non-software acquirers include the August 2016 Verizon acquisition of Fleetmatics, and the October 2015 Cox Automotive acquisition of Dealertrack.

Increasing Demand for Vertically-focused SaaS

- Vertical-focused SaaS companies have become increasingly more attractive targets as companies are realizing the increased benefits of specialization. Due to a targeted customer base, vertical SaaS companies can realize 8x cheaper customer acquisition costs than typical horizontal SaaS platforms. Further, companies are more easily able to adapt to the demands of its user-base, developing tailored features for a specific industry. Ultimately, this flexibility translates into decreased churn and the ability for further upsell opportunities with its current customer base.

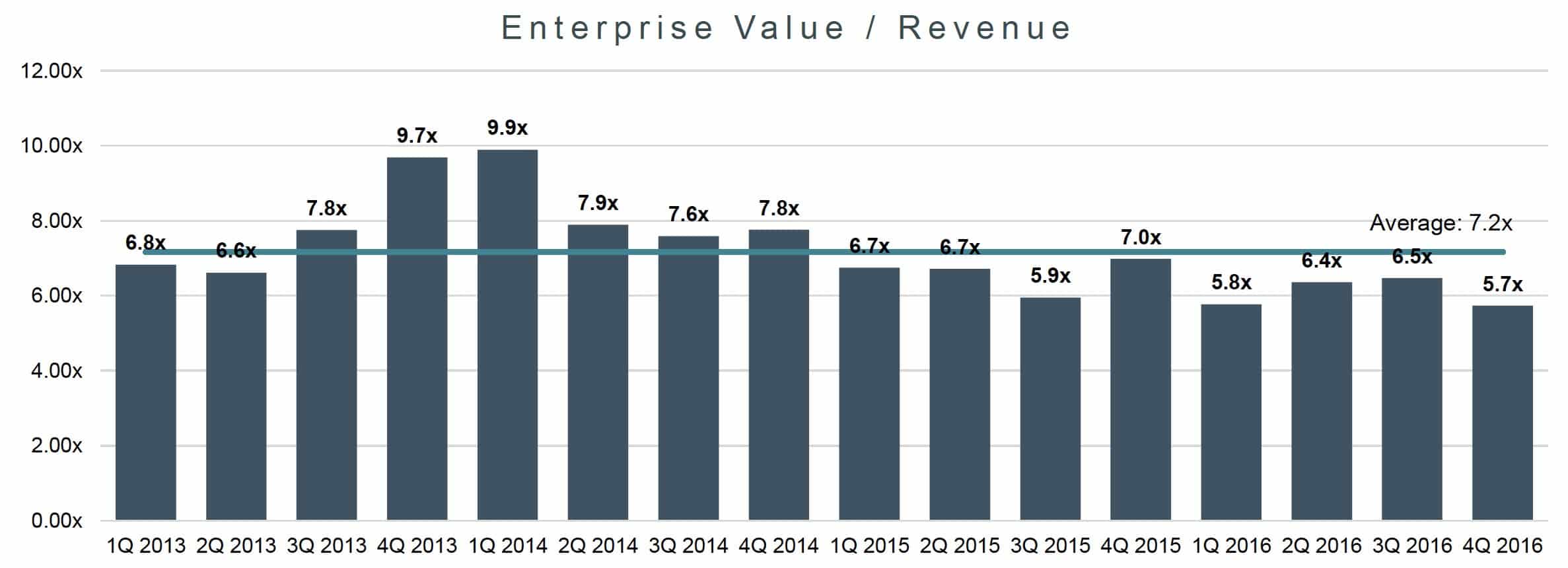

- As of March 2017, the median vertically-focused public SaaS comp was trading at 6.8x EV / REV compared to 3.8x for horizontal SaaS (based on an index of representative companies). The healthcare vertical followed by real estate and construction have been the most active verticals with 96 and 85 companies respectively, either going public or acquired during 2016.

- Recent transactions include West Corporation’s acquisition of 911ETC in the public safety vertical, and Roper Technologies’ acquisition of iSqFt in the construction vertical.

Recurring Revenue Profile Drives Continued Strong Private Equity Interest

- The recurring revenue nature of SaaS companies is expected to continue to attract interest from private equity groups. Several tech-focused firms have raised new funds in 2016, building dry powder to be deployed over the coming years.

- In early 2016, Thoma Bravo raised a $1.0 billion fund focused on lower middle market software investments. Additionally, in September the firm raised a $7.6 billion fund to pursue technology and software investments of all sizes.

- HGGC closed a $1.8 billion fund in December, The Firm seeks to invest in technology focused middle market companies.

- ParkerGale Capital closed a buyout fund of $240 million with a focus on founder-owned tech companies in the middle market.

- Vista Equity is currently raising its sixth fund and has become a key player in the technology middle market space.

- Throughout 2016, private equity firms have been notably active with several blockbuster take-private deals, including Vista Equity’s acquisition of Cvent and Thoma Bravo’s acquisition of Qlik Technologies.

Select Case Studies: Vertical SaaS

Target Description: Provider of eDiscovery review and analysis, and information analytics for the legal industry.

Investment Rationale: Complementary with OpenText’s enterprise information management solutions, expanding its eDiscovery and information analytics capabilities.

Buyer Quote: “Recommind information analytics can be used to solve problems at a scale not previously feasible without machine learning and is expected to be a critical component of the OpenText EIM strategy.”

Target Description: Provider of SaaS-based predictive analytics designed for Property/Casualty insurers.

Investment Rationale: Enables Guidewire’s customers to apply predictive analytics to make better decisions across the insurance lifecycle.

Buyer Quote: “…their expertise in Property/Casualty processes and data science will advance our mission of enabling insurers to adapt and succeed in a time of significant change.”

Select Case Studies: Horizontal SaaS

Target Description: Provider of HR, payroll, benefits and talent management software solutions.

Investment Rationale: Provides Asure with a comprehensive solution that brings workforce and workspace management together.

Buyer Quote: “…acquisition marks the culmination of a five-year technology strategy to bring a unified, people-centric platform to the HCM market.”

Target Description: Seattle-based provider of retail and fulfillment solutions.

Investment Rationale: Expands ecommerce offering by connecting a variety of physical and digital processes in the fulfillment management chain.

Buyer Quote: “The expansion of our ecommerce offerings will enable us to help our clients deliver a better consumer shopping experience from sales order to package delivery…”

Notable Recent Vertical SaaS M&A

| Date | Target | Buyer | Vertical | EV ($M) | EV/REV |

|---|---|---|---|---|---|

| Dec-16 | 911 ETC, Inc. | West Corporation (NasdaqGS:WSTC) | Public Safety | 10 | – |

| Oct-16 | iSqFt, Inc. | Roper Technologies, Inc. (NYSE:ROP) | Construction | 631 | – |

| Sep-16 | BIMobject AB (OM:BIM) | HCN Group AB | Construction | 68.7 | 25.6x |

| Jul-16 | CleanSpark LLC | CleanSpark, Inc. (OTCPK:CLSK) | Energy | 27.1 | – |

| Jun-16 | Recommind, Inc. | Open Text Corporation (NasdaqGS:OTEX) | Legal | 163 | 2.2x |

| May-16 | Vertafore | Bain Capital & Vista Equity | Insurance | – | – |

| May-16 | OPOWER | Oracle (NYSE:ORCLE) | Utility | 487.3 | 3.3 x |

| Apr-16 | Textura | Oracle (NYSE:ORCLE) | Construction | 619.4 | 6.7 x |

| Mar-16 | EagleEye Analytics, Inc. | Guidewire Software, Inc. (NYSE:GWRE) | Insurance | 42 | – |

| Feb-16 | Beanstalk Data | Heartland Payment Systems | Hospitality | – | – |

| Nov-15 | Trayport Limited | Intercontinental Exchange, Inc. (NYSE:ICE) | Finance | 860.1 | 11.0x |

| Nov-15 | Razorsight Corporation | Synchronoss Technologies, Inc. (NasdaqGS:SNCR) | Communications | 40.3 | – |

| Oct-15 | Benaissance LLC | WEX Health, Inc. | Healthcare | 80.7 | 6.1x |

| Oct-15 | Ex Libris | ProQuest | Education | – | – |

| Sep-15 | Mitratech Holdings | TA Associates | Legal | – | – |

| Sep-15 | Solera Holdings | Vista Equity | Insurance | – | – |

| Aug-15 | Smart Tuition, LLC | Blackbaud, Inc. (NasdaqGS:BLKB) | Education | 190 | – |

| Aug-15 | Internet Pipeline | ThomaBravo | Insurance | – | – |

| Jul-15 | On Center Software | Roper Technologies | Construction | 157 | – |

| Jul-15 | Fort Knox Financial Services Corporation | MetaBank | Finance | 41.4 | 1.6x |

| Jul-15 | SoftCare Solutions, Inc. | Medical Transcription Billing, Corp. (NasdaqCM:MTBC) | Healthcare | – | – |

| Jun-15 | InsureLinx, Inc. | Patriot Technology Solutions, Inc. | Insurance | 6 | – |

| May-15 | Dealer Rewards Of Canada 2014 Inc. | Ackroo Inc. (TSXV:AKR) | Automotive | 1.5 | – |

| May-15 | Acclaris, Inc. | Extend Health, Inc. | Healthcare | 140 | – |

Notable Recent Horizontal SaaS M&A

| Date | Target | Buyer | Vertical | EV ($M) | EV/REV |

|---|---|---|---|---|---|

| Dec-16 | F24 AG (DB:F2Y) | A.Ii Holding Ag | Messaging and notifications | 50.2 | 4.1x |

| Dec-16 | Revitas Inc. | Model N, Inc. (NYSE:MODN) | Contract and compliance management | 60 | – |

| Dec-16 | IntraLinks Holdings, Inc. | Synchronoss Technologies, Inc. (NasdaqGS:SNCR) | Content collaboration | 854.5 | 2.9x |

| Nov-16 | Pismo Soluções Tecnológicas Ltda. | – | Payment processing | 3.6 | – |

| Oct-16 | Appterra, Inc. | The Descartes Systems Group Inc (TSX:DSG) | Supply chain management | 7.4 | – |

| Oct-16 | Krux Digital Inc. | salesforce.com, inc. (NYSE:CRM) | Data management | 768 | – |

| Aug-16 | Fleetmatics Group PLC | Verizon Communications Inc. (NYSE:VZ) | Mobile workforce solutions | 2,183.50 | 7.0x |

| Jul-16 | Bridgevine Inc. | – | Marketing automation | 29.2 | – |

| Jul-16 | Appcito, Inc. | A10 Networks, Inc. (NYSE:ATEN) | Application delivery | 6.5 | – |

| Jul-16 | Good + Geek Inc. | Blackbaud, Inc. (NasdaqGS:BLKB) | Marketing automation | 3.9 | – |

| Jun-16 | iLab Solutions, LLC | Agilent Technologies, Inc. (NYSE:A) | Research management | 26 | – |

| Jun-16 | Badgeville, Inc. | Callidus Software Inc. (NasdaqGM:CALD) | Behavior management | 7.5 | – |

| Jun-16 | Telogis, Inc. | Verizon Telematics, Inc. | Asset location and management | 900 | – |

| May-16 | SciQuest, Inc. | Accel-KKR LLC | Spend management | 375.6 | 3.5x |

| May-16 | Vestrics, Inc. | The Ultimate Software Group, Inc. (NasdaqGS:ULTI) | Human capital analytics | 10.1 | – |

| May-16 | LeanLogistics, Inc. | Kewill plc | Transportation management | 115 | – |

| Apr-16 | BuddyBroker AG | XING AG (XTRA:O1BC) | Recruiting | 8.3 | – |

| Apr-16 | OpenSpan | Pegasystems | Human capital analytics | – | – |

| Apr-16 | Amtel | NetPlus | Mobile security & expense management | – | – |

| Apr-16 | ViewCentral, LLC | Callidus Software Inc. (NasdaqGM:CALD) | Learning management | 4 | – |

| Mar-16 | Verilume, Inc. | IntraLinks Holdings, Inc. | Data analytics | 6.3 | – |

| Mar-16 | Serena Software | Micro Focus | IT management | 540 | 3.3x |

| Mar-16 | Mangrove Software, Inc. | Asure Software, Inc. (NasdaqCM:ASUR) | Human capital management | 18.4 | – |

| Jan-16 | Investor Analytics, LLC | StatPro Inc. | Portfolio and risk management | 16 | 3.2x |

| Jan-16 | SmartVault | Reckon | Document management | – | – |

| Jan-16 | Empower | Kronos | Human capital management | – | – |

| Jan-16 | Enroute Systems Corporation | Pitney Bowes Inc. (NYSE:PBI) | Transportation management | 14 | – |

| Jan-16 | AssetPoint | Aptean | Maintenance management | – | – |

| Jan-16 | TalentWise | SterlingBackcheck | Human capital management | – | – |

| Nov-15 | Shopatron | Vista Equity | Order management | – | – |

| Nov-15 | Ultriva | Upland Software | Supply chain management | – | – |

| Nov-15 | Socialware, Inc. | Proofpoint, Inc. (NasdaqGM:PFPT) | Social media management | 9 | – |

| Nov-15 | Visirun SPA | Fleetmatics Group PLC | Fleet management | 29.7 | – |

| Nov-15 | Constant Contact | Endurance | Online marketing | – | – |

| Oct-15 | InfoNow Corporation (OTCPK:INOW) | Model N, Inc. (NYSE:MODN) | Channel management | 12.6 | – |

| Oct-15 | Vormetric, Inc. | Thales e-Security, Inc. | Data security | 421 | – |

| Aug-15 | Mashery | TIBCO | API Management | – | – |

| Aug-15 | Maxymiser | Oracle | Marketing | – | – |

| Aug-15 | Merchantry, Inc. | Tradeshift Inc. | eCommerce | 30 | – |

| Aug-15 | TechValidate | SurveyMonkey | Marketing automation | – | – |

| Apr-15 | MartJack | Capillary Technologies Pvt Ltd. | eCommerce | 32.3 | – |

Select Public Horizontal SaaS Companies

| Company | Gross margin | 1 Year Revenue Growth % | Market Cap | Net Debt | Enterprise Value | Revenue | EBITDA | EBITDA Margin | EV / Revenue |

|---|---|---|---|---|---|---|---|---|---|

| salesforce.com, inc. (NYSE:CRM) | – | 26% | $58,921 | $501 | $59,421 | $8,392 | $505 | 6% | 7.1x |

| Workday, Inc. (NYSE:WDAY) | 69% | 35% | $16,528 | -$1,462 | $15,066 | $1,569 | -$261 | -17% | 9.6x |

| LogMeIn, Inc. (NasdaqGS:LOGM) | – | 24% | $5,173 | -$167 | $5,007 | $336 | $41 | 12% | 14.9x |

| Zendesk, Inc. (NYSE:ZEN) | 70% | 49% | $2,610 | -$225 | $2,385 | $312 | -$84 | -27% | 7.6x |

| Box, Inc. (NYSE:BOX) | 72% | 32% | $2,097 | -$102 | $1,995 | $399 | -$115 | -29% | 5.0x |

| HubSpot, Inc. (NYSE:HUBS) | 77% | 49% | $2,094 | -$113 | $1,980 | $271 | -$39 | -14% | 7.3x |

| RingCentral, Inc. (NYSE:RNG) | 76% | 28% | $1,994 | -$145 | $1,848 | $380 | -$11 | -3% | 4.9x |

| TriNet Group, Inc. (NYSE:TNET) | 15% | 15% | $1,972 | $275 | $2,247 | $3,060 | $153 | 5% | 0.7x |

| Paylocity Holding Corporation (NasdaqGS:PCTY) | 57% | 41% | $1,881 | -$82 | $1,799 | $264 | $7 | 3% | 6.8x |

| Callidus Softw are Inc. (NasdaqGM:CALD) | 62% | 19% | $1,252 | -$185 | $1,068 | $207 | -$7 | -3% | 5.2x |

| Carbonite, Inc. (NasdaqGM:CARB) | 71% | 52% | $556 | -$59 | $497 | $207 | $19 | 9% | 2.4x |

| LivePerson, Inc. (NasdaqGS:LPSN) | 72% | -7% | $386 | -$51 | $335 | $223 | $2 | 1% | 1.5x |

| Xactly Corporation (NYSE:XTLY) | 61% | 26% | $363 | -$28 | $334 | $96 | -$12 | -13% | 3.5x |

| Bazaarvoice, Inc. (NasdaqGS:BV) | 62% | 2% | $335 | -$47 | $289 | $202 | -$8 | -4% | 1.4x |

| Brightcove Inc. (NasdaqGS:BCOV) | 63% | 12% | $278 | -$36 | $242 | $150 | -$1 | -1% | 1.6x |

| Zix Corporation (NasdaqGS:ZIXI) | 83% | 10% | $274 | -$27 | $247 | $60 | $12 | 20% | 4.1x |

| ChannelAdvisor Corporation (NYSE:ECOM) | 76% | 13% | $271 | -$62 | $210 | $113 | -$6 | -5% | 1.9x |

| Tangoe, Inc. (NasdaqGS:TNGO) | 54% | 6% | $229 | -$32 | $198 | $219 | $10 | 4% | 0.9x |

| Upland Softw are, Inc. (NasdaqGM:UPLD) | 63% | 6% | $215 | $22 | $237 | $73 | $5 | 7% | 3.2x |

| Amber Road, Inc. (NYSE:AMBR) | 51% | 9% | $184 | $7 | $191 | $73 | -$11 | -15% | 2.6x |

| Median | 66% | 22% | $904 | -$55 | $782 | $221 | -$4 | -2% | 3.8x |

| Mean | 64% | 22% | $4,880 | -$101 | $4,780 | $830 | $10 | -3% | 4.6x |

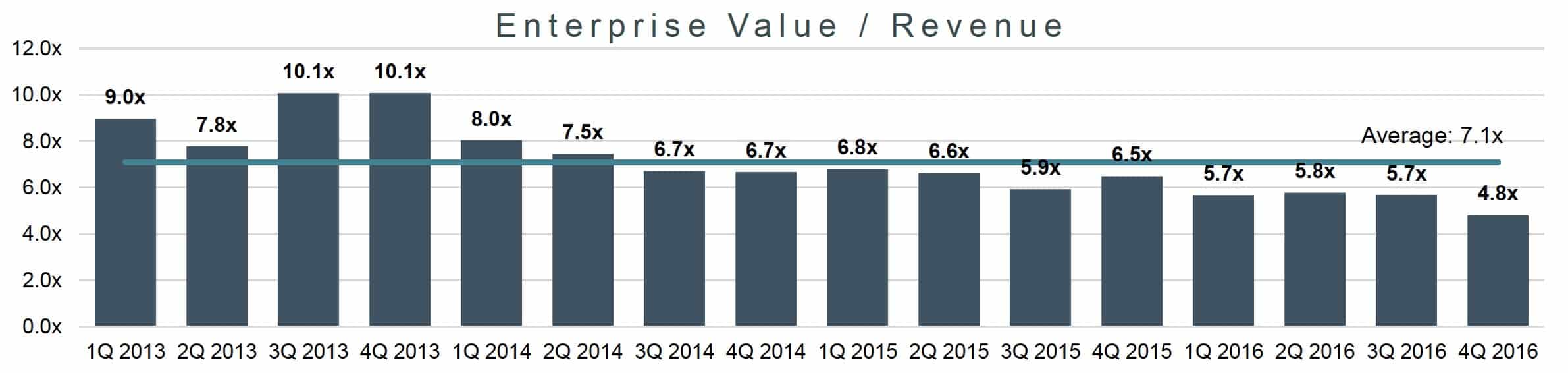

Horizontal SaaS Valuation Multiples

Select Public Vertical SaaS Companies

| Company | Gross margin | 1 Year Revenue Growth % | Market Cap | Net Debt | Enterprise Value | Revenue | EBITDA | EBITDA Margin | EV / Revenue |

|---|---|---|---|---|---|---|---|---|---|

| athenahealth, Inc. (NasdaqGS:ATHN) | 51% | 17% | $4,535 | $144 | $4,679 | $1,083 | $107 | 10% | 4.3x |

| RealPage, Inc. (NasdaqGS:RP) | 57% | 21% | $2,769 | $17 | $2,786 | $568 | $81 | 14% | 4.9x |

| Medidata Solutions, Inc. (NasdaqGS:MDSO) | 76% | 18% | $3,263 | -$111 | $3,151 | $463 | $66 | 14% | 6.8x |

| Guidew ire Softw are, Inc. (NYSE:GWRE) | 63% | 14% | $4,265 | -$583 | $3,682 | $450 | $19 | 4% | 8.2x |

| Veeva Systems Inc. (NYSE:VEEV) | 68% | 33% | $6,138 | -$519 | $5,619 | $544 | $122 | 22% | 10.3x |

| Castlight Health, Inc. (NYSE:CSLT) | 66% | 35% | $337 | -$115 | $223 | $102 | -$54 | NA | 2.2x |

| Ellie Mae, Inc. (NYSE:ELLI) | 67% | 42% | $3,316 | -$422 | $2,894 | $360 | $73 | 20% | 8.0x |

| Median | 66% | 21% | $3,316 | -$115 | $3,151 | $463 | $73 | 14% | 6.8x |

| Mean | 64% | 26% | $3,517 | -$227 | $3,291 | $510 | $59 | 14% | 6.4x |

Vertical SaaS Valuation Multiples