Classic Accessories: Consumer Products Acquisition Case Study

Published September 11, 2018

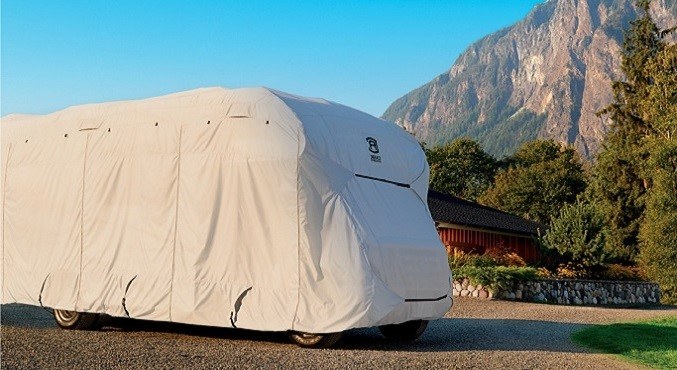

Based in Kent, WA, Classic Accessories is the leading North American designer and distributor of innovative textile products that cover, protect and organize outdoor gear. Founded in 1983 by Jacob Engelstein, Classic Accessories has grown from an automotive accessories business into a market leading, diversified, outdoor products accessories brand. Over the last 10 years, the Company has developed a strong position across the patio, RV, car and lawn markets. In particular, Classic Accessories had established exceptional product development, sourcing and online content capabilities.

The Objective

The Classic Accessories shareholder was seeking an investment banking partner with strong consumer products experience that could properly articulate the Company’s unique positioning in its category, strong relationship with ecommerce customers including Amazon and its niche market leadership. Meridian was selected following a year long, competitive vetting process. Goals for the transaction included a premium valuation, an efficient timeline and an incoming investor that was culturally and strategically aligned with the existing management team.

Meridian’s Approach

Meridian’s marketing process focused on private equity firms with strong consumer product experience and a history of successfully partnering with existing shareholder and management teams. Meridian created highly customized marketing materials that reflected Classic Accessories’ brand messaging and corporate vision. Among other traditional positioning points, Meridian’s materials and marketing strategy emphasized the following about Classic Accessories:

- Market leadership position within its category – Meridian worked to define the overall market size as well as Classic Accessories’ position within each sub-category in order to demonstrate leading market share.

- Sophisticated product development capabilities and approach to sourcing – Meridian articulated the infrastructure and investments made by the Company in order to depict the meaningful barriers to entries created by Classic Accessories’ product differentiation and its product portfolio breadth and depth.

- Established trade and consumer brand – Meridian used customer reviews, search engine results and consumer sell through data to demonstrate the strength and value of the Classic Accessories brand.

- Unique positioning and customer relationship with Amazon – Meridian successfully positioned Amazon as a channel as opposed to an individual customer, improving the Company’s position related to customer concentration and growth opportunities.

“Meridian was instrumental in helping identify and select a partner in alignment with our strategic goals moving forward.”

Brian Bozlinksi, President

Classic Accessories

Outcome

The Meridian Process generated thirteen indications of interest from investors with meaningful consumer experience. The investor pool was narrowed to six groups for management presentations, all of which submitted firm offers. Due to the high level of interest from potential investors, Classic Accessories was able to dictate attractive terms related to retained ownership for the shareholder, ongoing management roles and equity plans for management, and an expedited diligence schedule.

A transaction was ultimately completed with CID Capital, a leading consumer-focused private equity firm with strong cultural alignment with management team. The transaction included meaningful ongoing equity positions for both the shareholder and management team, reflecting the true partnership nature of the transaction. Additionally, the Company achieved a strong valuation representing nearly a 25% premium over the initial valuation guidance provided by Meridian.