Aerospace M&A Update – Spring 2018

Published April 15, 2018

Key Trends in Aerospace & Defense for 2018

Meridian Capital’s Aerospace and Defense M&A Update focuses on industry macro indicators, continued strength of the MRO market, Airbus’s U.S. supply chain, and the impact of Boeing’s Partnering for Success 2.0. Overall, 2017 proved to be another record year in aerospace and defense M&A activity. Total deal value reached over $70 billion across more than 450 transactions, though total value was heavily inflated by several blockbuster transactions.

Exceptional Results Delivered

- Over $5B in transaction experience

- Trusted advisor to leading middle market companies

- Focus on businesses with $20M to $500M+ in enterprise value

- 20+ years experience with complex corporate finance and M&A challenges

- 18 seasoned professionals with finance, operational, and legal backgrounds

Deep Industry Insights

- Dedicated Industry Teams

- Holistic Industry Coverage

- Deep Buyer Relationships

Transaction Expertise

- M&A

- Growth Capital

- Strategic Advisory

Customized Processes

- High Touch Approach

- Multidisciplinary Deal Team

- End-to-end Service

Aerospace Expertise

- Aerospace Components

- Precision Machining and Assembly

- MRO Components and Services

- Automation and Tooling

- Avionics

- Composites

International Aerospace Connections

Global M&A

Meridian Capital is a founding member of Global M&A Partners, a global partnership of independent, middle-market investment banking firms. Established in 1999, the partnership includes 34 investment banks with more than 200 M&A professionals transacting in over 50 countries. Combined the partnership has successfully completed over 1,500 transactions with combined value in excess of $50 billion over the past five years. Meridian is a leading member of the partnership’s Aerospace Coverage Team.

Aerospace Coverage Team Highlights

- Significant aerospace operational and transaction experience

- Global coverage across key geographic markets (50+ countries)

- Unmatched strategic relationships and investor access across aerospace industry

- Leading research and thought leadership

M&A Trends, Activity, and Public Comps

Industry M&A Trends

Twice a year, Meridian Capital publishes its Aerospace and Defense M&A Update, which focuses on key trends in the aerospace and defense M&A market. The Spring edition focuses on industry macro indicators, continued strength of the MRO market, Airbus’s U.S. supply chain, and the impact of Boeing’s Partnering for Success 2.0.

Overall, 2017 proved to be another record year in aerospace and defense M&A activity. Total deal value reached over $70 billion across more than 450 transactions, though total value was heavily inflated by several blockbuster transactions.

Strong Macro Economic Indicators Continue to Provide Industry Tailwinds

- In 2017, global passenger air traffic increased at a rate of 7.5%, according to IATA. This trend is projected to continue in 2018 with an estimated 4.3 billion passengers carried via commercial aircraft and 6.0% growth in revenue per kilometer (“RPK”). Continued growth in air travel will further bolster airlines’ financial performance and drive demand for new aircrafts.

- Asia Pacific, and China in particular, continue to see strong air travel growth. Passenger growth in China has quadrupled in the last 10 years and is projected to experience annual growth of 6% with fleet growth of nearly 5% through 2036.

- The cargo market experienced robust growth of over 9.5% in 2017, and IATA projects the market will grow 4.5% in 2018 reaching $59.2 billion in revenue. The cargo industry’s momentum is bolstering new aircraft orders as well as increased financial incentive for cargo conversions.

- As the relationship between interest rates (cost to acquire new aircraft) and oil prices (savings from operations of new aircraft) normalize, analysts expect a renewed uptick in aircraft order volume related to fuel efficiency savings.

- The culmination of these macro trends has resulted in 2018 having the best overall outlook in ten years with an overall projected industry growth rate of 5.2%, according to market research firm the Teal Group.

Source: Boeing, Airbus, IATA, Teal Group, Pitchbook, PwC

OEM Threat to MRO Providers

- Commercial airline maintenance, repair, and overhaul (“MRO”) remains an active subsegment for M&A. Interest from both financial and strategic investors has resulted in multiple transactions since Q3 2017. The industry as a whole is expected to grow at a CAGR of 3.8% from 2017 to 2027 reaching approximately a $110 billion market, according to Oliver Wyman

- Over the past several years, OEMs have continued to pressure smaller MRO providers by bringing manufacturing of select components in-house and capturing valuable aftermarket sales. Boeing and Airbus have both insourced work for wings, nacelles, and flight control actuation in order to better control production.

- Tier 1 providers of aftermarket parts and MRO services are looking to increase their value offerings and scale in order to remain competitive against OEMs. Of note, Standard Aero acquired Vector Aerospace in November, in order to expand its capabilities on select engines and enter the helicopter MRO market.

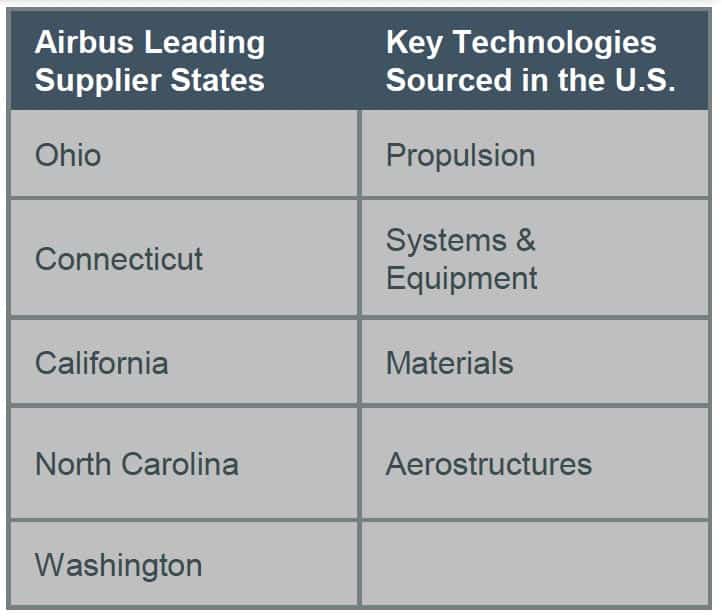

Growing Airbus Presence in the U.S.

- Airbus’s supply chain within the U.S. has continued to expand. Since 1990, Airbus has spent approximately $200 billion across 1,000+ U.S. suppliers, including $15 billion in 2017 alone.

- Airbus’s U.S. manufacturing facility in Mobile, Alabama produces aircraft in the A320 family, which has experienced a robust increase in build rates recently and is scheduled to ramp up to 60 aircrafts per month.

- Tier 1 and 2 suppliers are looking to increase exposure to Airbus platforms. Diversifying revenue with Airbus provides the opportunity for Boeing suppliers to insulate themselves from Boeing pricing and terms pressure.

- Because Airbus purchasing decisions are still driven out of France, regional companies already supplying Airbus are attractive potential acquisitions for suppliers seeking to gain access to the OEM.

Impact of Boeing’s “Partnering for Success 2.0”

- In 2012, Boeing rolled out its Partnering for Success (“PFS”) program aimed at cutting prices with suppliers ~15%. Recently, Boeing has instituted Partnering for Success 2.0 (“PFS2.0”), a program focused on supplier terms and conditions. Under PFS2.0, Boeing is seeking to further reduce costs with long-term pricing arrangements and revised terms and conditions. These negotiations include the lengthening of Boeing’s payment terms and the request for suppliers to hold a larger portion of the OEM’s inventory.

- As Boeing continues to pressure its supply chain, smaller suppliers are consolidating, supporting the shift from small, independently owned suppliers to larger suppliers with greater resources to meet Boeing’s demands.

- Consolidation has also occurred among the largest Tier 1 suppliers, creating companies with compelling value propositions and the scale to increase negotiating leverage with the key OEMs. These recent acquisitions include United Technologies’ acquisition of Rockwell Collins, Northrop Grumman’s acquisition of Orbital ATK, and Safran’s acquisition of Zodiac Aerospace.

Source: Boeing, Airbus, Oliver Wyman, Avascent, Pitchbook, PNAA

Select Transaction Case Studies

Target Description: Global leader in jet blast deflection and engine noise mitigation technology.

Investment Rationale: The Company has a historically high backlog of high profile projects and multi-year revenue streams.

Buyer Quote: “…the robust secular trends around commercial aviation provide BDI an attractive market opportunity in core and adjacent markets through organic and acquisitive growth, respectively.” –Andrew Ford, Principal at Hanover

Target Description: Manufacturer of complex 5-axis structural aerospace parts.

Investment Rationale: Thompson Street Capital and Onward Capital partnered to acquire Tech Manufacturing as an add-on to their joint platform company, Domaille Engineering.

Buyer Quote: “The resulting combination of talent and resources will allow us to deliver a broader solution to our customers.” – Tim Kanne, President of Domaille Engineering

Target Description: Leading provider of products that facilitate the transfer of fluids and gases at extreme temperatures and pressures for the aerospace, defense, and space industries.

Investment Rationale: The addition of FMH Aerospace adds to a variety of recent acquisitions aimed at broadening AMETEK’s instrumentation platform.

Buyer Quote: “We are very excited with the [acquisition] of FMH Aerospace as [it] offer[s] differentiated products serving an attractive market.” – David Zapico, CEO of AMETEK

Target Description: Provider of maintenance, repair, and overhaul services for the aerospace industry.

Investment Rationale: Expand international services and scale operations by combining similar companies.

Buyer Quote: “We are excited to join forces with the Vector team in becoming one of the largest MRO companies in the world.” – Russell Ford, CEO of StandardAero.

Notable Recent Transactions

| Date | Target | Buyer | Segment | EV ($M) | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|

| Mar-18 | Kirkhill | TransDigm Group | Components and Subsystems | $50.00 | 0.6x | – |

| Mar-18 | Blast Deflectors | Hanover Partners | Ground Support Equipment | – | – | – |

| Mar-18 | Stone Foundries | Aeromet via Privet Capital | Machined Components | |||

| Feb-18 | San Diego Composites | Applied Composites via AE Industrial Partners | Aerostructures | – | – | – |

| Feb-18 | Zodiac Aerospace (ZC) | Safran | Components and Subsystems | $7,700.00 | 1.4x | NM |

| Feb-18 | Tech Manufacturing | Domaille Engineering | Machined Parts | – | – | – |

| Jan-18 | Air Transport Components | Holder Family Investments | MRO | – | – | – |

| Jan-18 | FMH Aerospace | AMETEK | Components and Subsystems | $235.00 | 4.7x | – |

| Jan-18 | AERnnova | TowerBrook Capital Partners | Aerostructures | – | – | – |

| Dec-17 | Applied Composite Structures | AE Industrial Partners | Composites | – | – | – |

| Dec-17 | Recaero | iXO Private Equity | Machined Parts | – | – | – |

| Dec-17 | Oxford Performance Materials (Aerospace & Defense Business) | Hexcel | Components and Subsystems | – | – | – |

| Dec-17 | Malabar International | Tronair via Golden Gate Capital | Ground Support Equipment | – | – | – |

| Nov-17 | Cadence Aerospace | Arlington Capital Partners | Machined Parts | – | – | – |

| Nov-17 | Anodyne Electronics Manufacturing | Structural Monitoring | Components and Subsystems | $7.80 | – | – |

| Nov-17 | Oceania Aviation | Salus Aviation Group | MRO | – | – | – |

| Nov-17 | Vector Aerospace | StandardAero via Veritas Capital | MRO | $600.00 | 0.8x | – |

| Nov-17 | Mach Aero Bretigny Rectification | NMB Minebea | Machined Parts | – | – | – |

| Nov-17 | Forming and Machining Industries | AE Industrial Partners | Machined Parts | – | – | – |

| Nov-17 | Applied Composites Engineering | AE Industrial Partners | Composites | – | – | – |

| Oct-17 | Aviation Managed Solutions | Launch Technical Workforce Solutions | MRO | – | – | – |

| Oct-17 | Island Air (ATR inventory and Tooling) | AAR | MRO | – | – | – |

| Oct-17 | Sepang Aircraft Engineering | Airbus MRO | MRO | – | – | – |

| Oct-17 | Remos Aircraft | Stemme Aerostructures | Aerostructures | – | – | – |

| Oct-17 | Flite Line Equipment | Goldhofer Ground Support Equipment | Ground Support Equipment | – | – | – |

| Oct-17 | Loar Group | Abrams Capital | Components and Subsystems | – | – | – |

| Sep-17 | Plasco Tooling and Engineering | Visioneering via 3P Equity Partners and Silver Sail Capital | Automation and Tooling | – | – | – |

| Sep-17 | Orbital ATK | Northrop Grumman | Aerostructures | $9,200.00 | 1.9x | 13.5x |

| Sep-17 | Rotable Repairs | Desser Tire & Rubber via Graham Partners | MRO | – | – | – |

| Sep-17 | Rockwell Collins (COL) | United Technologies | Components and Subsystems | $30,000.00 | 3.9x | 17.7x |

| Sep-17 | WestWind Technologies | Strata-G Solutions | Components and Subsystems | – | – | – |

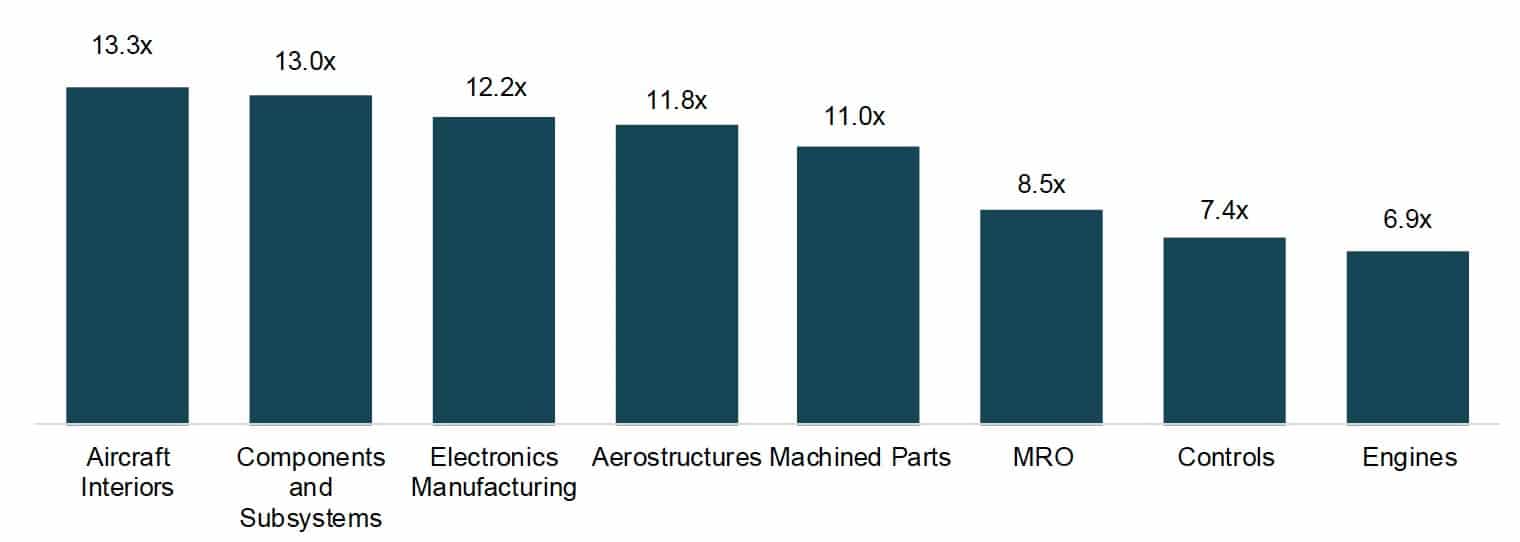

Transaction Multiple by Segment*

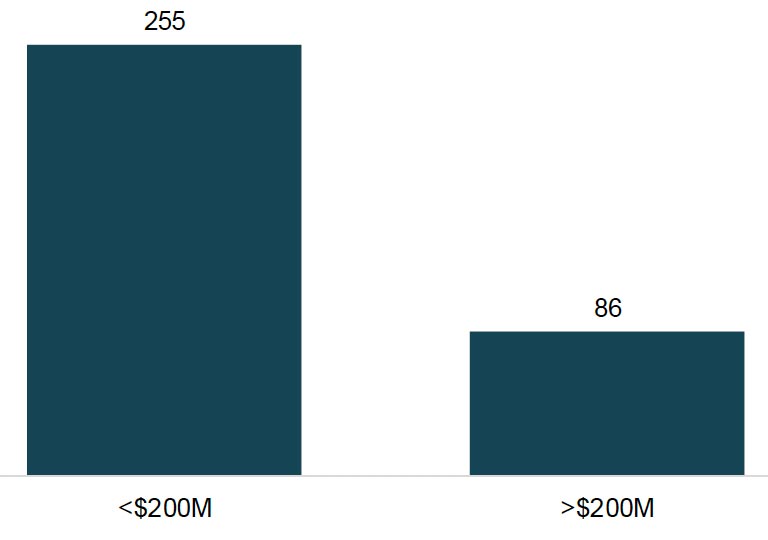

Transaction Volume by EV*

Select Public Aerospace Companies

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| The Boeing Company (NYSE:BA) | 187,683 | 188,265 | 93,392 | 12,546 | 2.0x | 15.0x | 13.4% | 82.3% |

| United Technologies Corporation (NYSE:UTX) | 99,267 | 119,709 | 59,837 | 10,812 | 2.0x | 11.1x | 18.1% | 9.4% |

| Airbus SE (ENXTPA:AIR) | 90,484 | 84,543 | 75,297 | 8,115 | 1.1x | 10.4x | 10.8% | 52.3% |

| Safran SA (ENXTPA:SAF) | 45,727 | 44,057 | 18,040 | 5,138 | 2.4x | 8.6x | 28.5% | 35.3% |

| TransDigm Group Incorporated (NYSE:TDG) | 15,801 | 26,691 | 3,538 | 1,641 | 7.5x | 16.3x | 46.4% | 41.1% |

| Textron Inc. (NYSE:TXT) | 14,925 | 17,575 | 14,129 | 1,314 | 1.2x | 13.4x | 9.3% | 22.9% |

| Spirit AeroSystems Holdings, Inc. (NYSE:SPR) | 9,567 | 10,295 | 6,983 | 784 | 1.5x | 13.1x | 11.2% | 46.6% |

| Zodiac Aerospace (ENXTPA:ZC) | 8,536 | 9,544 | 5,629 | 312 | 1.7x | 30.5x | 5.6% | 21.6% |

| MTU Aero Engines AG (XTRA:MTX) | 8,457 | 9,097 | 5,680 | 811 | 1.6x | 11.2x | 14.3% | 29.1% |

| HEICO Corporation (NYSE:HEI) | 8,130 | 8,397 | 1,586 | 391 | 5.3x | 21.5x | 24.7% | 55.2% |

| Bombardier Inc. (TSX:BBD.B) | 6,426 | 14,540 | 16,218 | 185 | 0.9x | NM | 1.1% | 85.9% |

| Hexcel Corporation (NYSE:HXL) | 5,788 | 6,538 | 1,973 | 455 | 3.3x | 14.4x | 23.1% | 21.3% |

| Embraer S.A. (BOVESPA:EMBR3) | 4,759 | 6,539 | 6,134 | 840 | 1.1x | 7.8x | 13.7% | 13.1% |

| Esterline Technologies Corporation (NYSE:ESL) | 2,195 | 2,195 | 2,002 | 299 | 1.1x | 7.4x | 14.9% | -13.2% |

| Senior plc (LSE:SNR) | 1,763 | 1,973 | 1,318 | 154 | 1.5x | 12.8x | 11.7% | 66.2% |

| Kaman Corporation (NYSE:KAMN) | 1,714 | 2,081 | 1,806 | 116 | 1.2x | 17.9x | 6.4% | 27.2% |

| Triumph Group, Inc. (NYSE:TGI) | 1,277 | 2,587 | 3,222 | -37 | 0.8x | NM | -1.1% | 4.1% |

| Ducommun Incorporated (NYSE:DCO) | 326 | 540 | 558 | 39 | 1.0x | 13.9x | 6.9% | 3.6% |

| Median | $8,294.00 | $9,320.00 | $5,654.00 | $620.00 | 1.5x | 13.3x | 12.6% | 28.1% |

| Mean | $28,490.00 | $30,842.00 | $17,630.00 | $2,440.00 | 2.1x | 14.1x | 14.4% | 33.6% |

Select Public Defense Companies

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Lockheed Martin Corporation (NYSE:LMT) | 93,507 | 104,983 | 51,048 | 7,115 | 2.1x | 14.8x | 13.9% | 25.9% |

| Raytheon Company (NYSE:RTN) | 60,329 | 61,979 | 25,348 | 3,847 | 2.4x | 16.1x | 15.2% | 42.0% |

| Northrop Grumman Corporation (NYSE:NOC) | 58,986 | 62,160 | 25,803 | 3,884 | 2.4x | 16.0x | 15.1% | 46.6% |

| BAE Systems plc (LSE:BA.) | 25,772 | 28,012 | 23,491 | 2,602 | 1.2x | 10.8x | 11.1% | -0.4% |

| Thales S.A. (ENXTPA:HO) | 25,314 | 22,986 | 16,648 | 1,943 | 1.4x | 11.8x | 11.7% | 22.7% |

| Rockw ell Collins, Inc. (NYSE:COL) | 22,127 | 28,926 | 7,640 | 1,696 | 3.8x | 17.1x | 22.2% | 38.3% |

| L3 Technologies, Inc. (NYSE:LLL) | 15,672 | 18,424 | 9,573 | 1,304 | 1.9x | 14.1x | 13.6% | 22.0% |

| Elbit Systems Ltd. (TASE:ESLT) | 5,507 | 5,793 | 3,378 | 415 | 1.7x | 13.9x | 12.3% | 16.7% |

| Kratos Defense & Security Solutions, Inc. (NasdaqGS:KTOS) | 965 | 1,129 | 752 | NM | 1.5x | NM | NM | 12.9% |

| Median | $25,314.00 | $28,012.00 | $16,648.00 | $2,273.00 | 1.9x | 14.4x | 13.8% | 22.7% |

| Mean | $34,242.00 | $37,155.00 | $18,187.00 | $2,851.00 | 2.0x | 14.3x | 14.4% | 25.2% |

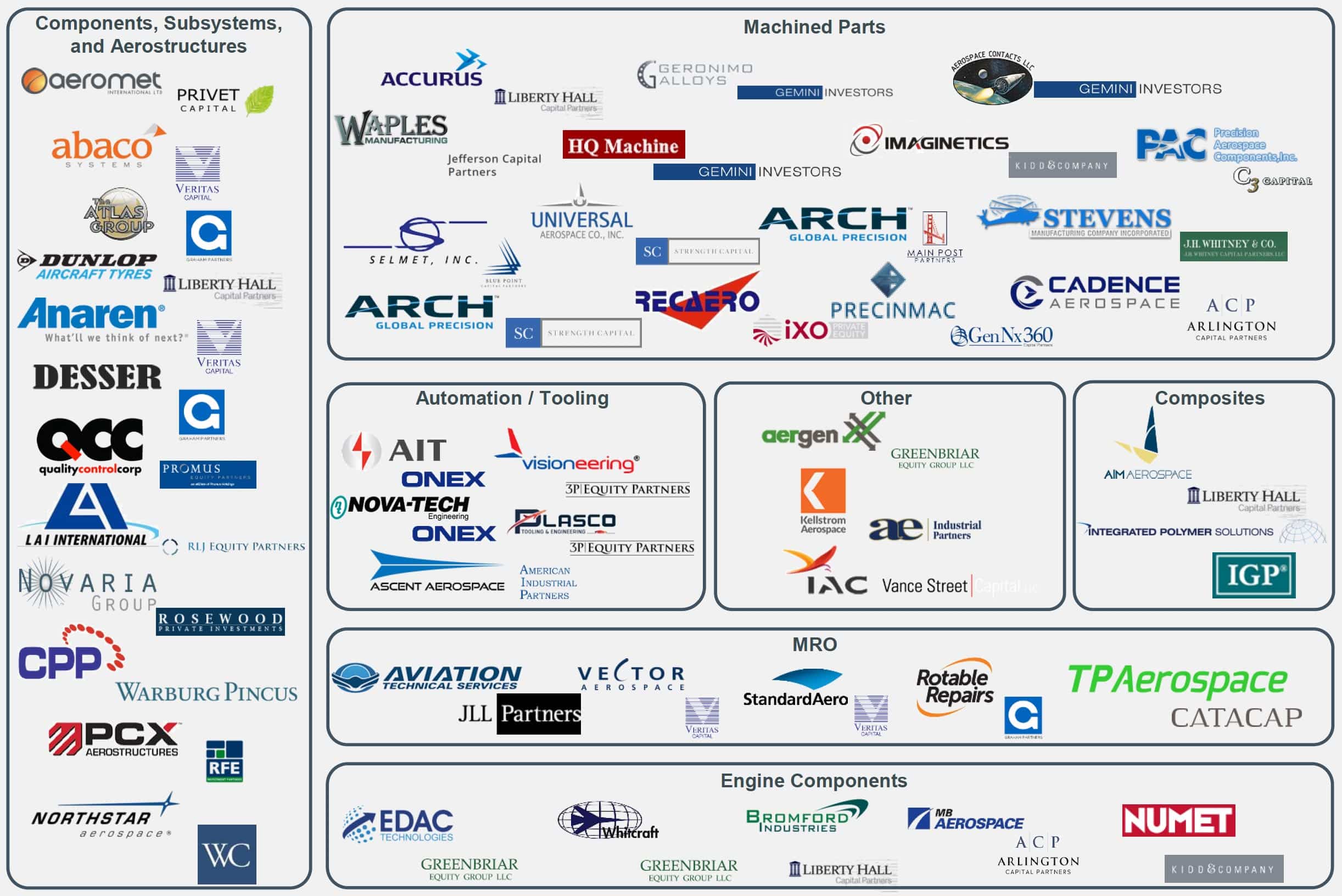

Selected Private Equity Investments in Sector