Food + Beverage M&A Update – Winter 2018

Published February 20, 2018

Key Trends in Food & Beverage for 2018

Meridian Capital’s Food and Beverage M&A Update focuses on shifting value propositions within traditional CPG companies, as well as recent activity in the protein alternatives and cannabis sectors.

M&A Activity and Public Market Metrics

M&A Trends

Plant-based Protein Garnering Strong Investment Interest

- The market for plant-based protein continues to evolve at a rapid pace as consumers display increased demand for products in this category. Driven by health, environmental, and animal welfare concerns, global sales of plant-based dairy and meat alternatives are forecasted to reach $19.5B and $5B, respectively, by 20201. Further, In 2017 U.S. sales of plant-based milk alternatives grew 3.1% while sales of cow’s milk declined 5%1.

- Plant-based food and beverage companies are garnering strong investment interest from both strategic corporations and financial firms. Nestle USA recently entered the plant-based food segment through the acquisition of Sweet Earth, a manufacturer of plant-based foods including meat alternatives. Impossible Foods, a provider of plant-based burgers, closed a $75M Series E venture round in a deal led by Temasek Holdings; the Company has raised more than $300M in total funding to date.

- Other notable transactions include: Maple Leaf Foods’s $120M acquisition of Field Roast Grain Meat and Dean Foods’s investment in Good Karma Foods, the leading producer of flaxseed-based milk and yogurt alternatives.

CPG Companies Shifting Core Value Propositions

- CPG manufacturers continue to adjust their product portfolios to better align with shifting consumer preferences. Growth within many CPG legacy brands has been stagnant, driving companies to seek acquisition and investment opportunities within higher-growth segments and diversify their core product mix.

- Kellogg’s acquisition of Chicago Bar, the owner of RXBAR protein bars, illustrates a recent strategic shift among processed food manufacturers to expand product offerings into healthier, higher-growth segments. Other notable transactions include General Mills’s investment in Urban Remedy, a producer of plant-based meals and beverages; Nestle’s divesture of its confectionery business, Hershey Co.’s acquisition of Amplify Snack Brands; and General Mills’ acquisition of Blue Buffalo Pet Food.

Growing Momentum in the Cannabis Industry

- M&A activity in the cannabis industry is gaining strong momentum as the legislation around both medical and recreational marijuana consumption continues to evolve. For U.S. companies operating in states where cannabis consumption has been legalized, there has been increased consolidation due to a variety of factors including: existing companies looking to expand their geographical footprint and product capabilities, new entrants seeking to acquire established assets, and legacy business founders seeking liquidation.

- M&A activity has also accelerated in the Canadian market where recreational marijuana is expected to become legalized on a National level by 2019. This year has already seen the largest cannabis marijuana M&A transaction as Canada’s second largest marijuana producer Aurora Cannabis has agreed to acquire smaller rival CanniMed Therapeutics for $852M.

- U.S.-based Constellation Brands, the $51B company behind Corona and Svedka, recently acquired a 9.9% stake valued at $191M in Canadian medical marijuana company Canopy Growth. The wine and spirits conglomerate has no intention of selling cannabis products in the U.S. until it is legal nationwide, but it has positioned itself to be an early entrant if and when it does.

1) Food Business News: “Interest in plant-based protein intensifies”

Select Case Studies

Target Description: Supplier of non-GMO and allergen-free snack products.

Investment Rationale: The acquisition will add to Hershey’s portfolio of snack brands and is expected to facilitate growth, cost synergies, and margin expansion.

Buyer Quote: “The acquisition is an important step in our journey to becoming an innovative snacking powerhouse as together it will enable us to bring scale and category management capabilities to a key sub-segment of the warehouse snack aisle.” – Michele Buck, CEO of Hershey Company

Target Description: Provider of plant-based frozen meals, burritos, breakfast sandwiches, and chilled plant-based burgers and proteins.

Investment Rationale: The acquisition gives Nestle instant access into the rapidly growing plant-based foods segment.

Buyer Quote: “In the US, we’re experiencing a consumer shift toward plant-based proteins. In fact, as many as 50 percent of consumers now are seeking more plant-based foods in their diet.”– Paul Grimwood, Nestle USA CEO

Target Description: Maker of BOOMCHICKAPOP, a gluten free, non-GMO, whole grain popcorn snack.

Investment Rationale: The deal adds to a series of acquisitions aimed at expanding Conagra’s portfolio of healthy snacks.

Buyer Quote: “Angie’s BOOMCHICKAPOP business is a leader in the fast-growing, better-for-you snacking segment. It will be a great complement to our growing snack business.” – Sean Connolly, President and CEO of Angie’s

Target Description: Leading manufacturer and brand of premium grain-based ‘meat’ and vegan cheese products.

Investment Rationale: The acquisition of Field Roast, along with Lightlife Foods acquired in early 2017, positions Maple Leaf as the leader in the U.S. retail market for plant-based proteins.

Buyer Quote: “This acquisition advance Maple Leaf’s vision to be the most sustainable protein company on earth.” – Maple Leaf Press Release

Notable Recent M&A Transactions

| Date | Target | Description | Buyer | Deal Size (M) | EV/ Revenue | EV/ EBITDA |

|---|---|---|---|---|---|---|

| Feb-18 | Mann Packing Co., Inc. | Vegetables | Fresh Del Monte Produce Inc. (NYSE:FDP) | $361.00 | 0.7x | – |

| Feb-18 | Blue Buffalo (NAS:BUFF) | Pet Food | General Mills | $8,000.00 | 6.2x | 25.9x |

| Jan-18 | Amplify Snack Brands, Inc. | Snack Foods | The Hershey Company (NYSE:HSY) | $1,536.00 | 4.3x | 19.9x |

| Jan-18 | Dr. Pepper Snapple Group (NYS:DPS) | Sodas and Juices | Keurig Green Mountain | $23,000.00 | 3.9x | 16.9x |

| Jan-18 | Field Roast Grain Meat Co., Inc. | Meat Products | Maple Leaf Foods Inc. (TSX:MFI) | $120.00 | 3.2x | – |

| Dec-17 | Northern Harvest Sea Farms Inc. | Salmon and Seafood | Marine Harvest ASA (OB:MHG) | $247.00 | – | – |

| Dec-17 | Sandwich Bros. of Wisconsin | Sandwiches | Conagra Brands, Inc. (NYSE:CAG) | $87.00 | – | – |

| Dec-17 | Galaxy Nutritional Foods, Inc. | Cheese Products | GreenSpace Brands Inc. (TSXV:JTR) | $17.00 | 1.0x | – |

| Dec-17 | Snyder’s-Lance, Inc. (NasdaqGS:LNCE) | Snack Foods | Campbell Soup Company (NYSE:CPB) | $6,136.00 | 2.7x | 19.9x |

| Dec-17 | Pendleton Whisky Brands | Distillers | Becle, S.A.B. de C.V. (BMV:CUERVO *) | $205.00 | – | – |

| Nov-17 | Richelieu Foods Inc. | Frozen Pizza and Sauces | Freiberger USA Inc. | $435.00 | 1.3x | – |

| Nov-17 | Tazo Tea Company | Teas and Herbs | Unilever United States, Inc. | $384.00 | 3.4x | – |

| Nov-17 | Betin, Inc | Goat Cheese | Saputo Inc. (TSX:SAP) | $264.00 | 2.3x | – |

| Oct-17 | Columbus Manufacturing, Inc. | Salamis and Deli Meats | Hormel Foods Corporation (NYSE:HRL) | $850.00 | 2.8x | – |

| Oct-17 | Inventure Foods, Inc. | Specialty Snacks | Utz Quality Foods, LLC | $143.00 | 0.5x | – |

| Oct-17 | Chicago Bar Company LLC | Protein Bars | Kellogg Company (NYSE:K) | $600.00 | – | – |

| Oct-17 | Angie’s Artisan Treats, LLC | Snack Foods | Conagra Brands, Inc. (NYSE:CAG) | $250.00 | – | – |

| Oct-17 | Omega Protein Corporation | Nutritional Foods | Cooke Inc. | $509.00 | 1.4x | 8.1x |

| Sep-17 | Sweet Earth Natural Foods | Plant-based Food Products | Nestle USA | – | – | – |

| Sep-17 | Sager Creek Vegetable Company, Inc. | Canned Vegetables | McCall Farms, Inc. | $55.00 | – | – |

| Sep-17 | Bob Evans Farms, Inc. | Frozen Foods | Post Holdings, Inc. (NYSE:POST) | $1,757.00 | 3.8x | 16.5x |

| Sep-17 | Rader Farms Inc. and Willamette Valley Fruit LLC | Berries | Oregon Potato Co. | $50.00 | – | – |

| Aug-17 | Fells Point Wholesale Meats, Inc. | Meat Products | The Chefs’ Warehouse, Inc. (NasdaqGS:CHEF) | $45.00 | – | – |

| Aug-17 | Boyd Coffee Company, Inc. | Coffees and Teas | Farmer Bros. Co. (NasdaqGS:FARM) | $59.00 | 0.6x | – |

| Aug-17 | Back to Nature Foods Company, LLC | Snack Foods | B&G Foods, Inc. (NYSE:BGS) | $163.00 | – | – |

| Aug-17 | Capitol Wholesale Meats, Inc. | Meat Products | Hormel Foods Corporation (NYSE:HRL) | $425.00 | – | – |

| Aug-17 | Preferred Brands International Inc. | Ready-to-eat Asian Entrees | Effem Holdings Ltd. | $173.00 | – | – |

| Jul-17 | Daiya Foods Inc. | Plant-based food and Bev | Otsuka Pharmaceutical Co., Ltd. | $323.00 | 4.5x | NA |

| Jul-17 | Creekstone Farms Premium Beef, LLC | Premium Beef | Marubeni Corporation (TSE:8002) | $170.00 | 0.3x | NA |

| Jul-17 | East Balt, Inc. | Breads | Grupo Bimbo, S.A.B. de C.V. (BMV:BIMBO A) | $650.00 | 1.6x | 9.3x |

| Jul-17 | French’s Food companies and Tigers Milk LLC | Packaged Food | McCormick & Company, Incorporated (NYSE:MKC) | $4,200.00 | 7.5x | NA |

| Jul-17 | Albertville Quality Foods, Inc. | Protein | OK Foods, Inc. | $140.00 | 0.5x | NA |

| Jul-17 | H&N Distribution, Inc. | Food and Ingredients | United 1 International Laboratories LLC | $19.00 | NA | NA |

| Jul-17 | L.B. Maple Treat Corporation | Maple Syrup | Lantic Inc. | $124.00 | 1.0x | 8.7x |

| Jul-17 | Pacific Foods of Oregon, Inc. | Natural and Organic Foods | Campbell Investment Company | $700.00 | 3.2x | – |

| Jul-17 | Stonyfield Farm, Inc. | Organic Yogurt | Groupe Lactalis S.A. | $875.00 | 2.8x | – |

| Median | $264.00 | 2.7x | 16.5x | |||

| Average | $1,516.00 | 2.6x | 15.5x |

Select Public Food and Beverage Companies

| Company | Gross Margin | 1 Yr Revenue Growth | Market Cap | Net Debt | Enterprise Value | Revenue | EBITDA | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| B&G Foods, Inc. (NYSE:BGS) | 29% | 22% | $1,842.00 | $1,830.00 | $3,672.00 | $1,608.00 | $293.00 | 2.3x | 12.5x |

| Campbell Soup Company (NYSE:CPB) | 38% | -1% | $12,941.00 | $3,298.00 | $16,247.00 | $7,849.00 | $1,678.00 | 2.1x | 9.7x |

| Conagra Brands, Inc. (NYSE:CAG) | 30% | -5% | $14,476.00 | $3,444.00 | $18,008.00 | $7,821.00 | $1,277.00 | 2.3x | 14.1x |

| Dean Foods Company (NYSE:DF) | 24% | 2% | $790.00 | $922.00 | $1,713.00 | $7,878.00 | $300.00 | 0.2x | 5.7x |

| Dr Pepper Snapple Group, Inc. (NYSE:DPS) | 60% | 4% | $20,895.00 | $4,418.00 | $25,313.00 | $6,690.00 | $1,563.00 | 3.8x | 16.2x |

| Flowers Foods, Inc. (NYSE:FLO) | 49% | 0% | $4,368.00 | $833.00 | $5,201.00 | $3,921.00 | $310.00 | 1.3x | 16.8x |

| General Mills, Inc. (NYSE:GIS) | 35% | -2% | $28,765.00 | $8,765.00 | $38,682.00 | $15,568.00 | $3,399.00 | 2.5x | 11.4x |

| Hormel Foods Corporation (NYSE:HRL) | 22% | -4% | $17,190.00 | ($194.00) | $17,000.00 | $9,168.00 | $1,411.00 | 1.9x | 12.0x |

| Kellogg Company (NYSE:K) | 39% | -1% | $22,889.00 | $8,334.00 | $31,239.00 | $12,923.00 | $2,411.00 | 2.4x | 13.0x |

| Pepsico, Inc. (NYSE:PEP) | 55% | 1% | $157,525.00 | $17,985.00 | $175,510.00 | $63,591.00 | $12,718.00 | 2.8x | 13.8x |

| Pinnacle Foods Inc. (NYSE:PF) | 28% | 4% | $6,422.00 | $2,841.00 | $9,264.00 | $3,119.00 | $557.00 | 3.0x | 16.6x |

| Post Holdings, Inc. (NYSE:POST) | 30% | 8% | $5,207.00 | $5,590.00 | $10,807.00 | $5,409.00 | $635.00 | 2.0x | 17.0x |

| Seneca Foods Corporation (NasdaqGS:SENE.A) | 7% | 2% | $289.00 | $446.00 | $736.00 | $1,315.00 | $46.00 | 0.6x | 15.9x |

| The Coca-Cola Company (NYSE:KO) | 62% | -12% | $184,372.00 | $21,743.00 | $206,148.00 | $37,307.00 | $7,924.00 | 5.5x | 26.0x |

| The Hain Celestial Group, Inc. (NasdaqGS:HAIN) | 20% | 1% | $3,614.00 | $628.00 | $4,242.00 | $2,915.00 | $195.00 | 1.5x | 21.8x |

| The Hershey Company (NYSE:HSY) | 46% | 1% | $20,682.00 | $2,540.00 | $23,239.00 | $7,515.00 | $1,471.00 | 3.1x | 15.8x |

| J&J Snack Foods Corp (NASDAQ: JJSF) | 30% | 13% | $2,509.00 | ($129.00) | $2,380.00 | $1,124.00 | $124.00 | 2.1x | 19.2x |

| The J. M. Smucker Company (NYSE:SJM) | 38% | -2% | $14,348.00 | $5,077.00 | $19,425.00 | $7,335.00 | $1,421.00 | 2.6x | 13.7x |

| The Kraft Heinz Company (NasdaqGS:KHC) | 37% | -1% | $81,721.00 | $29,907.00 | $111,841.00 | $26,232.00 | $7,800.00 | 4.3x | 14.3x |

| Treehouse Foods, Inc. (NYSE:THS) | 17% | 2% | $2,147.00 | $2,399.00 | $4,546.00 | $6,307.00 | ($115.00) | 0.7x | NM |

| Tyson Foods, Inc. (NYSE:TSN) | 13% | 6% | $27,336.00 | $9,393.00 | $36,748.00 | $39,307.00 | $3,673.00 | 0.9x | 10.0x |

| Average | 34% | 2% | $30,016.00 | $6,194.00 | $36,284.00 | $13,091.00 | $2,338.00 | 2.3x | 14.8x |

| Median | 30% | 1% | $14,348.00 | $3,298.00 | $17,000.00 | $7,515.00 | $1,411.00 | 2.3x | 14.2x |

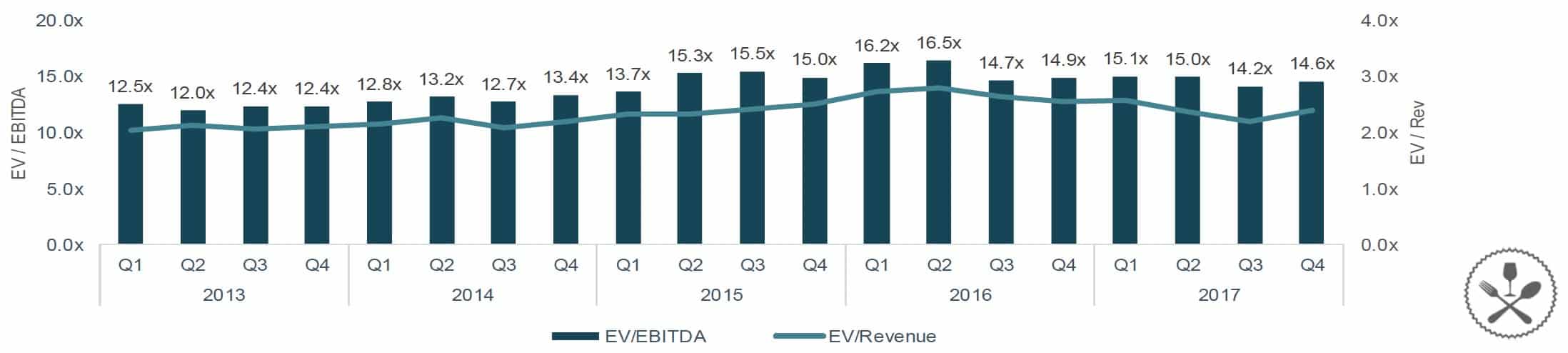

Food & Beverage Valuation Multiples (2013 – 2017)